Fixed costs are costs that are incurred by an organization for producing or selling an item and do not depend on the level of production or the number of units sold. Some common examples of fixed costs include rent, insurance premiums, and salaries. You can see that all of these costs do not change even if you increase production or make more sales in a particular month. Let’s take a look at how cutting costs can impact your break-even point.

What Happens to the Breakeven Point If Sales Change?

For options trading, the breakeven point is the market price that an underlying asset must reach for an option buyer to avoid a loss if they exercise the option. The breakeven point doesn’t typically factor in commission costs, although these fees could be included if desired. Break-even analysis works well for short-term planning, like setting immediate sales goals or dedication to prices.

- Traders can use break-even analysis to set realistic profit targets, manage risk, and make informed trading decisions.

- The break-even point is the point at which there is no profit or loss.

- In addition, changes to the relevant range may change, meaning fixed costs can even change.

- From this analysis, you can see that if you can reduce the cost variables, you can lower your breakeven point without having to raise your price.

- Next, Barbara can translate the number of units into total sales dollars by multiplying the 2,500 units by the total sales price for each unit of $500.

How much will you need each month during retirement?

In our example, Barbara had to produce and sell 2,500 units to cover the factory expenditures and had to produce 3,500 units in order to meet her profit objectives. It’s the amount of sales the company can afford to lose but still cover its expenditures. Now Barbara can go back to the board and say that the company must sell at least 2,500 units or the equivalent of $1,250,000 in sales before any profits are realized. As the owner of a small business, you can see that any decision you make about pricing your product, the costs you incur in your business, and sales volume are interrelated. Calculating the breakeven point is just one component of cost-volume-profit analysis, but it’s often an essential first step in establishing a sales price point that ensures a profit.

Depreciation Calculators

This $40 reflects the revenue collected to cover the remaining fixed costs, which are excluded when figuring the contribution margin. Break-even analysis looks at fixed costs relative to the profit earned by each additional unit produced and sold. Let’s say that we have a company that sells products priced at $20.00 per unit, so revenue will be equal to the number of units sold multiplied by the $20.00 price tag. The break-even point is crucial for businesses to ensure that they are not operating at a loss. It helps you understand how much money you need to make before you start generating profits, allowing for more effective financial planning. He is considering introducing a new soft drink, called Sam’s Silly Soda.

Kesalahan Umum dalam Menghitung BEP dan Cara Menghindarinya

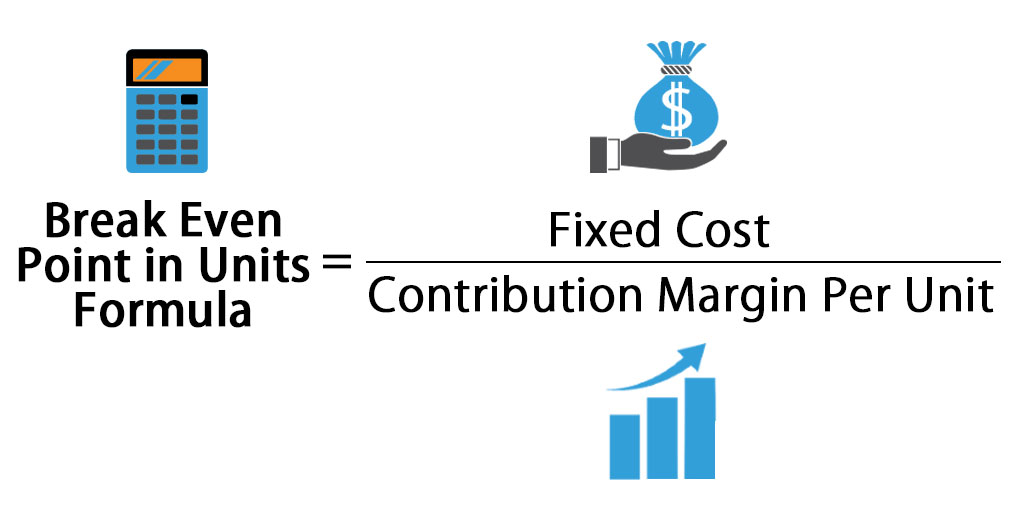

So, after deducting $10.00 from $20.00, the contribution margin comes out to $10.00. Calculating the breakeven point is a key financial analysis tool used by business owners. Once you know the fixed and variable costs for the product your business produces or a good approximation of them, you can use that information to calculate your company’s breakeven point. Small business owners can salary or draw use the calculation to determine how many product units they need to sell at a given price point to break even. Another limitation is that the breakeven point assumes that sales prices, variable costs per unit, and total fixed costs remain constant, which is often not the case. The price of goods sold at fluctuates, and the cost of raw materials may hardly stay stable.

In reality, some costs may not fit cleanly into these categories. For example, semi-variable costs, which have both fixed and variable components, can complicate the accuracy of the breakeven calculation which then changes the breakeven point in units. Note that in the prior example, the fixed costs are “paid for” by the contribution margin. The more profit a company makes on its units, the fewer it needs to sell to break even. If you won’t be able to reach the break-even point based on your current price, you may want to increase it.

Break-even analysis helps businesses choose pricing strategies, and manage costs and operations. In stock and options trading, break-even analysis helps determine the minimum price movements required to cover trading costs and make a profit. Traders can use break-even analysis to set realistic profit targets, manage risk, and make informed trading decisions.

In other words, your company is neither making money nor losing it. Use your break-even point to determine how much you need to sell to cover costs or make a profit. And, monitor your break-even point to help set budgets, control costs, and decide a pricing strategy. Typically, the first time you reach a break-even point means a positive turn for your business. When you break-even, you’re finally making enough to cover your operating costs.

QuickBooks can assist with tasks from bookkeeping and payroll to inventory analysis and profitability. Contact us today to discover what QuickBooks can do to help you with all of your small business accounting needs. When analyzing your break-even point, not only do you want to see that your business is breaking even, you’re looking to make sure your business is profitable as well. Here are a few ways to lower your break-even point and increase your profit margin.

Just because the break-even analysis determines the number of products you need to sell, there’s no guarantee that they will sell. Fixed Costs – Fixed costs are ones that typically do not change, or change only slightly. Examples of fixed costs for a business are monthly utility expenses and rent.

Once you’re above the break-even point, every additional unit you sell increases profit by the amount of the unit contribution margin. This is the amount each unit contributes to paying off fixed costs and increasing profits, and it’s the denominator of the break-even analysis formula. To find it, subtract variable costs per unit from sales price per unit.